Digital wallet & payment data copilot

Paycake enables simple and secure direct bank payments and transforms payment data into engagement.

Contact us

We believe embedded finance experiences are a key strategic element of an immersive customer experience that delivers:

- More customers

- More spend

- More frequency

- More transactions

- More data

Solutions for a better experience

For Financial Institutions

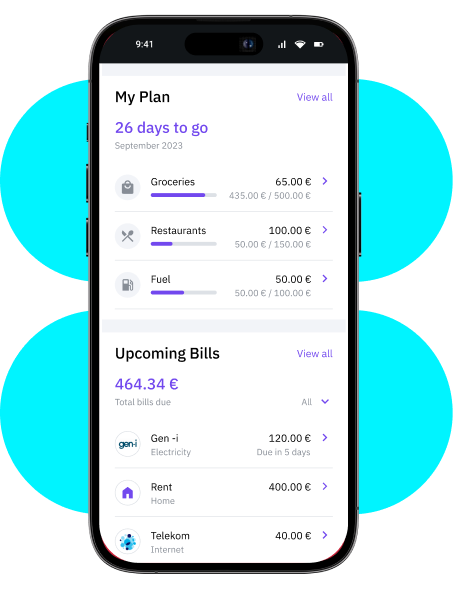

Technology and apps are an important part of the banking experience. Users expect them to be simple, intuitive and part of their everyday lives.PayCake complements the bank's existing digital tools and enables it to develop new revenue streams that create value from Big Data.

PayCake helps banks deepen relationships with their retail customers, making them more personal and engaged.

API microservices integration enables maximum customization in terms of UX design, full adaptability to existing and legacy IT infrastructures, and little or no management and maintenance resources.

For Businesses

What information is more powerful than knowing where your target customers regularly shop and why you are their first or second choice?

PayCake outperforms all other marketing channels by linking customer incentives and engagement at the level of their bank account or a payment card.

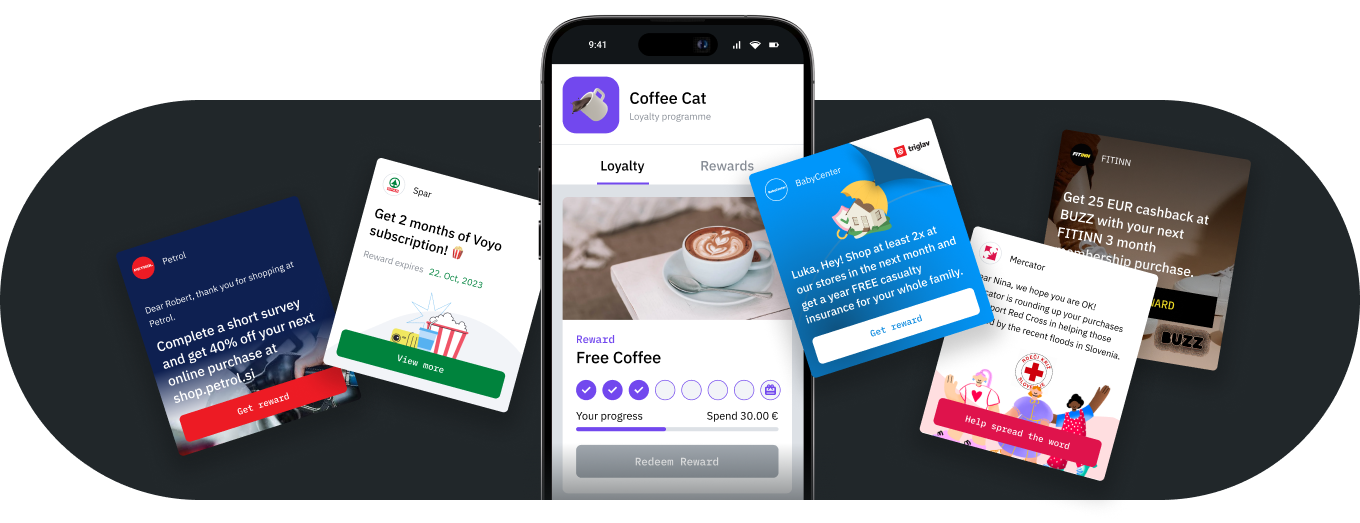

Set up your own and custom branded rewards and loyalty mobile app in minutes. Introduce bank-to-bank instant payments and avoid high card fees. No integrations or development skills required.

PayCake is designed to help businesses understand and engage consumers effectively, at low cost and without the hassle of complex development or software integrations.

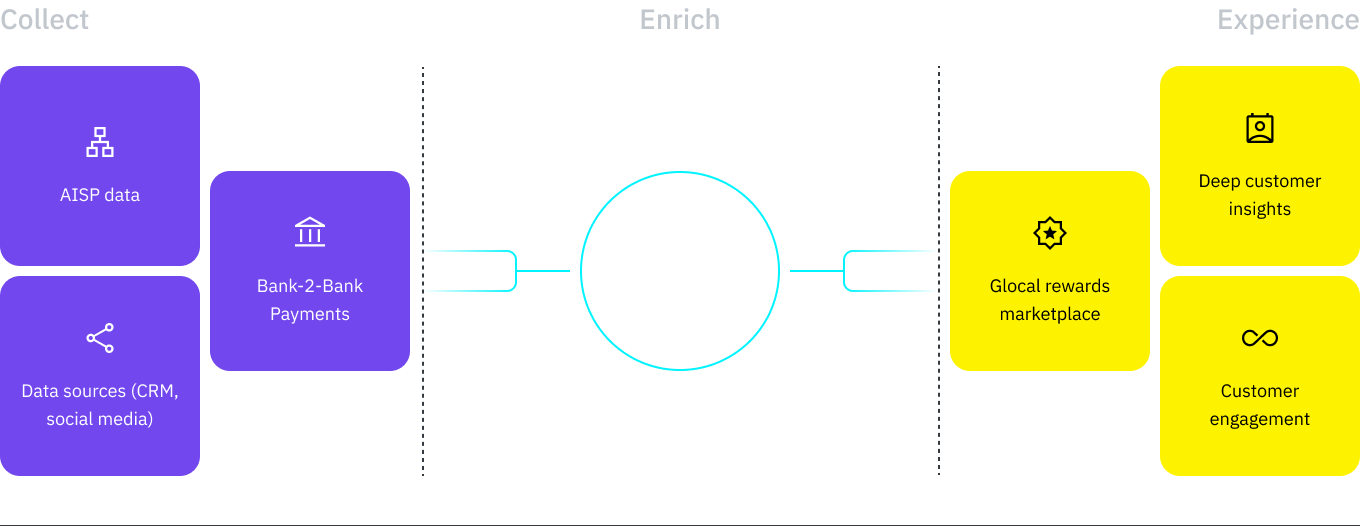

PayCake is an API suite of microservices that combines the functionality of digital wallets with loyalty programmes and Big Data analytics.

Connect to 2.100+ banks (AISP) with an out of the box, fully customisable consent flow, data sharing dashboard and advanced user management portal. Collect instant, one-off payments. Or automated recurring payments. Without expensive fees or hidden costs.

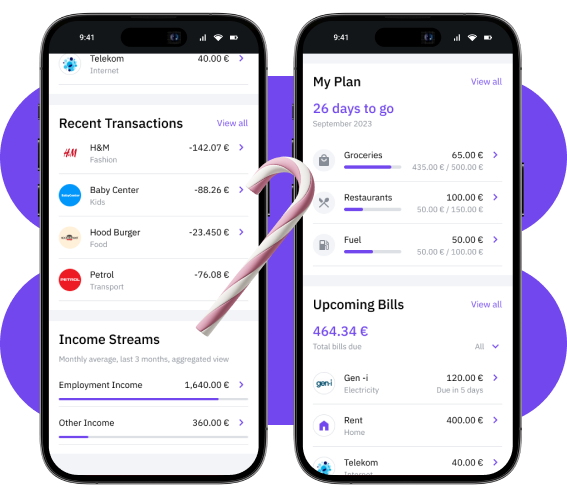

Categorise transactions, detect monthly bills, subscriptions, classify merchants and verify income salary with 98% accuracy. Paycake can interpret a customers financial footprint and predict future spending habits,as well as calculate Share-of-Wallet or tell you the location of most frequent purchases and more, lots more.

Offer digital gifts and rewards from over 250,000 - and growing daily - global and local shops and online shops. For incentives, gifts, rewards, competitions, customer satisfaction surveys and more. Our API puts you in control of your rewards and loyalty programmes.

Collect

Onboarding automation

Open Banking can streamline the onboarding process by helping users automatically fill in their requests using AISP data.

Account verification

Customers can easily prove account ownership using Open Banking data, when they're setting up payments.

Multi-banking

Use open banking data to offer customers an overview of their finances, including accounts they hold with other banks.

Instant and reliable access to transaction data from over 2.100+ financial institutions and plug & play access to Open Banking powered use cases.

Consent management

- A user friendly, end-to-end consent process available on web and app

- Data sharing dashboard for users to see and manage consents

- Automated consent renewal notifications

Data aggregation

- Instant access to all live Data Holders, with new banks and products added as they become available

- Real time user initiated data refresh, plus optional background data refresh up to 5 times per day

One-off and recurring payments

- Let your customers pay directly from their bank account. It's quick, easy and skips the high card fees

- It's better for you and better for your customers

Advanced features

- Out of the box detailed custom reporting on consents, users and performance

- Configure consent options, select available providers, customise branding and much more to build the perfect user experience for your customers

Enrich

"Big data can be big, Paycake makes big data smart?"

Transaction categorisation

Adds context to transactions by grouping them into meaningful categories

Bill detection

Automatically detect regular transactions like rent, utilities and subscriptions

Add data sources

Optionally add other sources of 3rd party data, eg. social media or CRM

Merchant classification

Identify merchants and enrich them with relevant information

Identify income and expenses

Automatically classify salary payments as income and assign expenses into custom labels

Assign Carbon Footprint Data

Automatically assign verified CO2eq data to transactions based category

Experience

Users are generally unwilling to follow links to browse for offers or activate rewards in hopes of receiving them promptly.

PayCake uses a consumers purchase data and attributes rewards to purchases without consumers needing to activate offers or subscribe to loyalty and reward programs. This is the key to fluid user experiences and a guarantee for a higer campaign success / opt-in rate.

Attract more customers

Sign Up Deals And Referral Campaigns

For lead generation and trial boost, offer sign up deals for new customers to on-board them by the masses and turn loyal customers into a marketing tool with a stand-out referral campaign.

Grow more spend & frequency

Customer Segmentation

It's all in the details. Prove that you understand their wants and needs by segmenting and targeting your customers. It will drive increased basket values and frequency.

Engage more data

Customer Analytics

Thanks to our dashboard, you can reward customers based on their location or previous shopping habits. Grow your database, get to know your customers, engage with them and get feedback.

Retain more transactions

Targeted Campaigns

Whether you're targeting and rewarding new customers or are identifying slipping customers and incentivising them to get back in store - give customers what they want, when they want it.

* Any trade marks/names, pictures and mockups featured in this document are owned by the respective trade mark owners. Where a trade mark or brand name is referred to it is used solely for demonstration purposes.

* Any trade marks/names, pictures and mockups featured in this document are owned by the respective trade mark owners. Where a trade mark or brand name is referred to it is used solely for demonstration purposes.

Off-the-shelf Use Cases we can support you with

Whether you know exactly what you're looking for, or need help figuring out what's right for you: Get in touch and let's build your business together.

Improve financial wellbeing of customers

It's their money, their rules. And your tools

PayCake uses a consumers purchase data and attributes rewards to purchases without consumers needing to activate offers or subscribe to loyalty and reward programs. This is the key to fluid user experiences and a guarantee for a higer campaign success / opt-in rate.

A Custom Branded Payment, Ordering & Loyalty App

Plug & Play, deep insights, performance fees

Engage your customers with a digital loyalty programme that automatically sends rewards and emails to your customers, generating additional revenue for your business. Achieve up to 72 % higher opt-in rates compared to concentional card-based loyalty, and reduce transaction costs by up to 80%.

Launch an incetives marketplace for your bank

Improve business with relevancy and personalisation

Attract and retain business customers by offering them a bank-branded solution to bost their sales, acquire new customers and monetise existing customer bases. Banks benefit from higher revenue per customer, higher SME acquisition rates and greater data capabilities.

Create a cashback platform for your customers

Investing in loyalty pays off

Do you have a group of dedicated members or customers? Would you like to offer additional services to improve customer retention and satisfaction? Contact us today to enquire about our affordable and easy to set up cashback platform.

Why partner with Paycake?

We ensure flexibility to tailor our systems to your customers' needs, efficiency in creation and implementation, industry-leading expertise to guide development and strategy, and advanced security to protect business and consumer data.

Goal-oriented

We focus on achieving better results for your clients. From boosting sales and engagement to reducing debt or increasing savings and getting a better overview of their finances.

Advanced and reliable

Complete customisability and advanced features built on a robust and reliable platform.

Just the way you want it

A modular, end-to-end platform, from pure AISP data collection and PSP instant payments to a fully integrated use case delivered in a white label app, we have it all for you.